Real-Time Payment Market Soars with Demand for Instant Transactions, Mobile Payments, and Blockchain Integration

The Real-Time Payment Market thrives on the need for immediate fund transfers, increased mobile payment adoption, and consumer preference for digital wallets.

AUSTIN, TX, UNITED STATES, December 9, 2024 /EINPresswire.com/ -- Market Scope and Overview

The Real-Time Payment Market is witnessing remarkable growth driven by the increasing demand for faster, secure, and seamless digital payment solutions in a highly interconnected world.

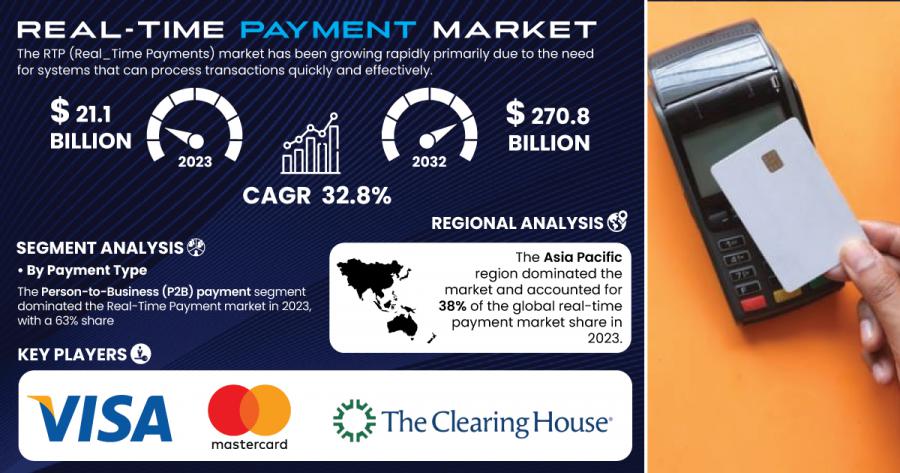

The Real-Time Payment Market was valued at USD 21.1 billion in 2023 and is projected to reach an impressive USD 270.8 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 32.8% during the forecast period from 2024 to 2032.

Market Drivers

The surging demand for real-time payment solutions is driven by the growing need for speed, efficiency, and transparency in financial transactions. Traditional payment methods, often plagued by delays and inefficiencies, are being rapidly replaced by real-time systems that enable instant fund transfers, improving cash flow and enhancing customer satisfaction. Both businesses and consumers are embracing these systems as they facilitate seamless, immediate payments, which are especially critical in the fast-paced digital economy. The adoption of mobile banking, e-commerce platforms, and digital wallets has further accelerated the transition to real-time payment systems, reshaping the global financial landscape. According to a 2024 report by the World Bank, mobile payment transactions globally have grown by over 28% annually in the past five years, underscoring the increasing reliance on digital financial services.

Additionally, the widespread use of smartphones and expanding internet access have created an optimal environment for the proliferation of digital payment platforms. The global smartphone penetration reached 78% in 2023, with regions like Asia-Pacific and Africa driving this growth. Governments are also playing a pivotal role in fostering real-time payment adoption. For example, India’s Unified Payments Interface (UPI) processed over 9 billion transactions monthly in 2024, while Brazil’s PIX system reported more than $8 trillion in transactions since its launch in 2020. These initiatives underscore a global push towards cashless economies, ensuring secure, fast, and efficient financial transactions.

Get a Report Sample of Real-Time Payment Market @ https://www.snsinsider.com/sample-request/3115

Some of the Major Key Players in the Real-Time Payment Market are:

✦ Visa (Visa Direct, Visa B2B Connect)

✦ MasterCard (MasterCard Send, MasterCard RTP)

✦ The Clearing House (RTP Network, Payment Solutions)

✦ PayPal (Xoom, PayPal Instant Transfer)

✦ Bitpanda (Bitpanda Pay, Bitpanda Pro)

✦ Deutsche Bank (RTP Payments Solution, Cash Management)

✦ Ripple Labs (RippleNet, On-Demand Liquidity)

✦ FIS (RealNet, PayNet)

✦ ACI Worldwide (ACI Real-Time Payment, ACI Payments Hub)

✦ Worldpay (Worldpay Instant Payments, Worldpay B2B Payments)

✦ Others

Market Segmentation

By Payment Type

In 2023, the Person-to-Business (P2B) payment segment dominated the Real-Time Payment Market, accounting for a substantial 63% share of the global revenue. P2B payments have gained immense traction due to the rapid expansion of e-commerce, retail, and utility services that demand instant, hassle-free payment mechanisms. Businesses are leveraging real-time payment solutions to improve cash flow management and reduce transaction costs, providing an edge in today’s competitive marketplace. This segment is expected to maintain its dominance, driven by the continuous rise in digital consumer behavior.

By Component

The Solutions segment emerged as the largest contributor in 2023, holding over 75% of the Real-Time Payment Market’s revenue share. This segment encompasses payment gateways, security and fraud management systems, and payment analytics platforms, which form the backbone of real-time payment ecosystems. Enterprises increasingly rely on these solutions to streamline operations, enhance user experience, and safeguard transactions against evolving cyber threats. The demand for integrated and scalable solutions is poised to fuel the segment's growth further.

Market Segmentation and Sub-Segmentation Included Are:

By Payment Type

✦ P2B

✦ B2B

✦ P2P

✦ Others

By Enterprise Size

✦ Large Enterprises

✦ Small & Medium Enterprises

By Component

✦ Solutions

✧ Payment Gateway

✧ Payment Processing

✧ Security Fraud Management

✧ Advisory Services

✦ Services

✧ Advisory Services

✧ Integration & Implementation Services

✧ Managed Services

By Deployment

✦ Cloud

✦ On-premise

By End-Use Industry

✦ BFSI

✦ IT

✦ Telecommunications

✦ Retail

✦ e-commerce

✦ Government

✦ Energy

✦ Utilities

✦ Others

Enquire for More Details @ https://www.snsinsider.com/enquiry/3115

Regional Analysis

Asia-Pacific led the Real-Time Payment Market in 2023, accounting for 38% of the global market share. The region’s dominance can be attributed to the widespread adoption of digital payment platforms in countries like India, China, and Japan. Government initiatives, such as India’s Unified Payments Interface (UPI) and China’s mobile payment boom led by Alipay and WeChat Pay, have significantly boosted real-time payment adoption. Furthermore, a young, tech-savvy population and the expansion of e-commerce in the region are driving the demand for instantaneous payment solutions.

North American region growing at a significant growth rate, characterized by a robust financial infrastructure and high consumer adoption rates. The U.S. is witnessing increased implementation of real-time payment platforms by financial institutions to meet the growing demand for instant and secure transactions. Additionally, ongoing collaborations between fintech companies and banks are fostering innovation in this space. Europe is also experiencing steady growth in the Real-Time Payment Market, driven by regulatory frameworks like the Revised Payment Services Directive (PSD2), which promotes open banking and real-time payment adoption. The region's emphasis on cross-border real-time payment capabilities is creating lucrative opportunities for market players.

Recent Developments

✦ Launch of FedNow by the Federal Reserve (July 2024): The U.S. Federal Reserve introduced FedNow, a real-time payment and settlement system, to enhance payment speed and efficiency across the country.

✦ Collaboration Between Visa and Paytm (August 2024): Visa partnered with India-based Paytm to integrate real-time payment capabilities into its ecosystem, enabling seamless fund transfers for users.

Buy Complete Real-Time Payment Market Report PDF @ https://www.snsinsider.com/checkout/3115

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Real-Time Payment Market Segmentation, By Payment Type

8. Real-Time Payment Market Segmentation, By Enterprise Size

9. Real-Time Payment Market Segmentation, By Deployment

10. Real-Time Payment Market Segmentation, By Component

11. Real-Time Payment Market Segmentation, By End-use Industry

12. Regional Analysis

13. Company Profile

14. Competitive Landscape

15. USE Cases and Best Practices

16. Conclusion

About Us

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: IT Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release