Fulton County Residential Property Set Records in 2025

O'Connor discusses how Fulton County residential property taxes set new records in 2025.

ATLANTA, GA, UNITED STATES, July 1, 2025 /EINPresswire.com/ --

While Cobb, DeKalb, and Gwinnett Counties are all parts of the Atlanta metropolitan area, only Fulton County can boast of being home to the city itself. One of the fastest growing and most diverse cities in the world, Atlanta is quickly becoming an economic and cultural cornerstone on which the United States is built. With both suburban and urban areas of Fulton County growing like weeds, the future for the Atlanta area is looking brighter than ever.

With only Austin possibly being the trendier city, people are flocking to Atlanta in droves. While this is usually a good thing, it is also dramatically pushing up the property values across the board. Higher property values always mean higher property taxes, and those in Fulton County are some of the fastest rising in the country. This makes it harder for traditional families to stay in their homes, while also increasing rents.

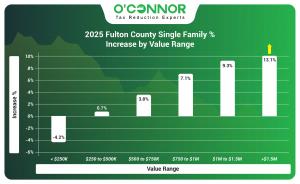

Fulton County Family Housing Values Rise 5.9%

Fulton County’s assessed home values increased by 5.9%, the fastest of the Atlanta Counties with the exception of Gwinnett, which jumped by 7.9%. According to the Fulton County Board of Assessors, the total market value for residential property was $141.66 billion, up from $133.78 billion. To illustrate how fast home values in Fulton County are growing, homes worth over $1.5 million saw their value grow by 13.1%, making them the biggest contributor to overall value. Homes worth between $500,000 and $750,000 added the second most to total value but were followed closely by those worth $250,000 to $500,000.

When examined by how large homes are, it is clear that Fulton County properties are skyrocketing across the board. With homes worth over $1.5 million being the most valuable block of residential properties, one would assume that this means Atlanta is loaded with mansions. On the contrary, large homes only contributed $13.32 billion in value. That means that homes of average sizes are rapidly climbing in value. Homes between 2,000 and 3,999 square feet added $68.01 billion to the total value. This was followed by homes that were less than 2,000 square feet, which added $32.07 billion. Larger homes did see higher increases in value by percentage, with the largest of homes growing by 11.8%.

Atlanta and Fulton County’s growth and vitality are evident when looking at the age of their residential properties. 33% of all value was constructed between 1981 and 2000, while 30% was built between 2001 and 2020. Homes built before 1960 are still going strong; however, making up 21% of the value. New construction, as one would guess, saw the biggest rise in percentage with 35.4%, and now makes up around 4% of all value in Fulton County. With growth across the board, this means even the most well-established families are seeing tax increases on their homes.

Fulton County Could be Overvalued

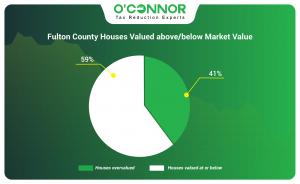

While anyone with a working pair of eyes can see that Fulton County is going through a boom period, there is a strong chance that the Fulton County Board of Assessors is overcooking the values somewhat. It was revealed that around 41% of all Fulton County residential properties were overvalued in 2025. Considering that values are already in the stratosphere, that only compounds issues. This is an improvement over 2023, when 61% of homes were overvalued. While things seem to be slowly going in the right direction, this should give a ton of evidence that property tax appeals are becoming a necessity in Fulton County, even if it is just to maintain peace of mind.

Adding more fuel to the fire, a recent study by Georgia MLS Real Estate Services, a resource for realtors and brokers in the region, showed evidence of more overvaluation. According to their independent research into home sales, the average price of a Fulton County home rose by 3.7%, compared to the 5.9% put forward by the Board of Appraisers. While both show a steady jump in housing values, the Georgia MLS study seems to be closer to the real value of property. Again, this shows why homeowners are encouraged to appeal their property values every year.

Fulton Commercial Values Jump 5.8%

While it is easy to empathize with homeowners when their properties climb out of affordability, it should be noted that unfair taxes on commercial properties can be just as devastating for a community. In general, commercial property values were raised 5.8% across Fulton County. Totaling over $47.12 billion, Fulton County boasts an impressive commercial property portfolio. $41.87 billion of the total value comes from businesses worth over $5 million. These big businesses also saw their value rise by 6%. Commercial properties worth between $500,000 and $1 million grew by 8.1%, but this was a comparable drop in the bucket.

Like most urban areas, the No. 1 commercial property is apartments. Multifamily homes contributed $23.10 billion to the grand total, while also going up in value by 7.9%. Offices were the No. 2 commercial property, though they went down in value by 2.3%. Warehouses, retail, and hotels all increased by double digits; 16.5%, 12.2%, and 12.2% respectively. Even raw, undeveloped land was valued at $2.42 billion. Whether this increase in assessed value means economic growth or simply higher taxes is up for debate, but things are getting more expensive either way.

When looked at by age of construction, commercial value follows a similar pattern to homes. 62% of all value was built between 1981 and 2020, with 2001 to 2020 being the biggest slice. The largest difference between homes and businesses comes in the form of new construction. Atlanta and Fulton County are seeing a building boom when it comes to commercial property, as new construction now accounts for 11% of all assessed value. New construction grew in value by 76.2% in 2025, adding $2.32 billion to its total.

Commercial Property Inflated?

While even the Fulton County Board of Appraisers admits that 41% of residential properties are overvalued, it is harder to get a read on what the truth is for commercial properties. A study by real estate analyst firm Green Street showed that commercial property across the United States is down 21% in value. This is certainly a large change compared to Fulton County’s appraised value of a 5.8% increase. Green Street claims that the value of commercial property is down thanks to economic factors like inflation, interest rates, and the bond market being more appealing. It should be noted that this applies to the entire US economy, and not a bustling community like the Atlanta area. Still, it raises valid questions that should be explored with a property tax appeal.

Atlanta Apartment Values Soaring

The total value of Fulton County apartments was raised by 7.9% in 2025. This is a significant burden for landlords, which is then transferred to renters. When broken down by the age of construction, the population boom of Atlanta can be seen easily. Of the $23.10 billion in apartment value, $14.36 billion of it was constructed between 2001 and 2020. This gets even more impressive when new construction is added to the mix, as it already represents 16% of the apartment total. In fact, new construction increased in value by 120% in 2025, showing that housing is in demand more than ever.

The majority of apartments being recent construction can also be illustrated in their subtype. $17.61 billion of the total value was produced by garden apartments. This modern subtype easily outstrips generic apartments, which totaled $5.43 billion. High-rise apartments grew the most in percentage, adding 86.5% in 2025. High-rise apartments are the newest configuration type, which matches up with the meteoric rise of recent construction.

Atlanta Offices Lose Value

As we have seen, it is rare to see Fulton County values trend downward, even in the most obscure category. This finally gets a shakeup when we examine office properties. In total, offices are down 2.2% in assessed value. Most office value was built between 1961 and 2020, which accounts for 82% of the total. This segment saw value fall by 5.5%, which obviously took the grand total with it. However, new construction mitigated this somewhat, jumping 19.1% in 2025 alone. Recent construction now accounts for 10% of all office space, a rarity across the United States.

$12.26 billion of the total value is in low-rise offices. It is this subtype that tanked by 2.6%, which in turn took down the average. While a smaller piece of the pie, medical offices were able to go in the opposite direction, adding 5.2% to their second-place finish. High-rise buildings only make up $344.23 million of the office total and saw a tiny bump of 0.1%.

Fulton Retail Climb 12.2%

While offices took a step back, retail property values exploded in 2025, going up 12.2% overall. Retail spaces are a rarity in Fulton County, as most value comes from older buildings. Retail buildings constructed between 1981 and 2000 account for 35% of all value, with those built between 1961 and 1980 totaling 28%. Even those older than 1960 logged 13% of all retail property. Each of these older property categories saw their appraised value climb by double digits in 2025. New construction added 9% to become a paltry 2% of the total.

The two biggest sources of retail value are strip centers and single-occupancy stores. These two subtypes accounted for a combined $1.89 billion in value, while also increasing 15.2% and 10.5%, respectively. Regional shopping malls were the No. 3 subtype, with $738.72 million, along with a jump of 10.6%. Community shopping centers were a rare negative, with 5.9% of value lost.

Warehouse Value Rises 16.5%

No Fulton County commercial property grew more as a whole than warehouses. Jumping 16.5% in 2025, warehouses got a boost from both old buildings and new construction. The value created by newly built warehouses rose a staggering 295%, bringing recent construction to 6% of all warehouse value. 84% of all warehouse value in Fulton County was built between 1961 and 2000, while 11% was created between 2001 and 2020.

Warehouses in Fulton County are divided into three subtypes. The standard warehouse commanded the most value with $1.46 billion, growing its lead by 19.2% in 2025. Mini warehouses totaled $269.79 million, while office warehouses netted $242.83 million. Office warehouses managed a solid jump of 14.2%.

Fulton County Overtaxed and Overpriced

Fulton County’s reputation for increasing costs and value is well-deserved. We can observe that housing values are reaching staggering heights. Despite homes worth over $1.5 million becoming the biggest contributor to total value, we did not see a corresponding growth in mansion-sized buildings. In fact, when comparing worth to size, we see that homes once meant for working families are now costing as much as a luxury spread in another county. This is a big indicator of gentrification, something that can damage traditional communities.

Gentrification has been a specter over the entire Atlanta area. There have been significant demographic swings in every county in the area. Fulton County is quickly outpricing both established citizens and those that wish to move in. While economics makes some of this inevitable, it is clear that around half of all homes are overpriced. This opens the door for property tax protests. There have been record protests filed in Fulton, Gwinnett, Cobb, and DeKalb Counties, and it is clear to see why. Whether it is a residential home or a business, the only way to get a correct valuation is to appeal.

O’Connor is here to help. We have been protesting taxes for 50 years and have established an office in the Atlanta area. Besides the high taxes, one thing that drew our attention to Fulton and surrounding counties is the property tax freeze. This is triggered when the value of a property is successfully appealed, locking in the value of the property for three years. With how quickly the prices of property in Fulton County are rising, freezing your taxes for several years is a boon that cannot be missed. O’Connor will protest your taxes every year, ensuring that you are always paying your fair share, and hopefully, landing you a tax freeze. There are no upfront costs or hidden fees, you will only pay if we lower your taxes.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Georgia, Texas, Illinois, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release